Ramsbottom: 3 reasons to pack your bags and move here!

At Pearson Ferrier, we’ve dedicated over a quarter of a century to helping families discover their ideal homes in the uniquely charming town of ...

Buying a first home can be a pretty daunting experience, not least if you’re doing it with your partner. On the one hand it can help ease any financial strains that you may have by sharing the responsibility, but on the other it’s also a big commitment to make with someone else.

It’s not all doom and gloom though, especially when you know what you’re getting yourselves into. Like with most big decisions, it helps to plan ahead. Buying a house is no different.

If you’re considering making your first step on the property ladder by moving in with your partner, feel free to consult our first home guide below to assist you with any queries you may be having.

Helpful tips for moving house

1. Identify your priorities

This should be your FIRST, SECOND, THIRD and FOURTH priority on your list of things to do. Seriously, you need to identify the most important things you’re both looking for in a property and run with it.

– How many bedrooms?

– Is the kitchen size adequate?

– Do you need off-street parking?

– How close are schools?

– What is the area like?

These are just a few of the things you should be considering when choosing a new home.

2. Configure which type of ownership would work best

Typically there are two different types of ownership to choose from when moving in with a partner. They are:

Joint tenants

– You have equal rights to the whole property

– If you die, the property automatically goes to the other owner

– You can’t pass on the ownership of the property in your will.Tenants in common

– You can own different shares of the property

– If you die, your share doesn’t automatically go to the other owner

– You can leave your share to another in your will.

3. Check your credit report

Once you have settled on a house both you and your partner want to buy, you should check your credit report. The better your credit rating, the better your chances of securing a more favourable mortgage are.

Be wary that there are plenty of negative actions which can affect lender’s views when assessing your credit. For instance, any late or missed payments on your card could have a huge impact on the outcome.

4. Calculate the overall cost of buying

This includes any additional fees that you may have to fork out, whether it’s surveys, valuation fees, stamp duty and potential repairs. That dream house may seem too good to be true and in a lot of cases it might be, so be sure to double-check everything before committing yourself to such a life changing decision.

5. Apply for a joint mortgage

When it comes to applying for a joint mortgage, you should remember that your credit score will be taken into account. That way, when you apply for credit in future, lenders can see who you are linked to and can take their reports into account.

6. Create a living together agreement / exit plan

Living with another person introduces a number of lifestyle changes, so creating a living together agreement could be very beneficial. This can record what each person will contribute to the household and so on, whether it’s expenses and debts, or arranging savings and pensions.

As horrible as it sounds, there may come a time where either yourself or your partner decides to move out or sell. Just to be on the safe side you should both make an exit plan. This can help protect your investment and keep you above water in the future.

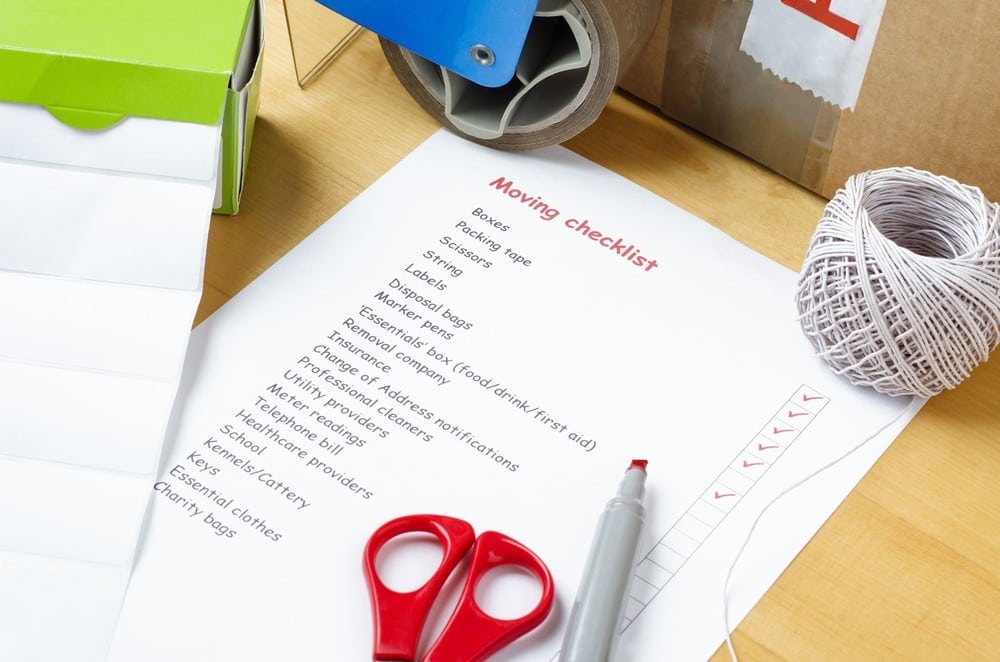

7. Set up a checklist for moving house

Moving into a new home can be as fun or gruelling as you make it, but one sure fire way of making it easier is to create a checklist. Time and again people make the same moving mistakes and end up dealing with the consequences later, so think smart and plan your next move carefully.

Making the decision to buy a property with your spouse or partner is a very big decision which requires a lot of thought. Fortunately, you have us on your side. Here at Pearson Ferrier we have a team of expert advisors on hand who can help find the best deals for your current situation.

For more information on how one of the UK’s leading property specialists can assist your move, get in touch with us today on 0161 764 4440 or fill out our contact form. We look forward to hearing from you!